Welcome to iHeartKPIs

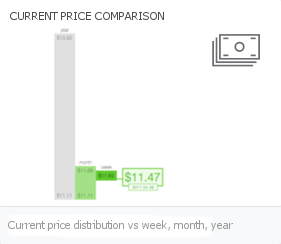

We love KPIs -- key performance indicators -- especiallywhen they point us to the right investment

opportunities at the right time!

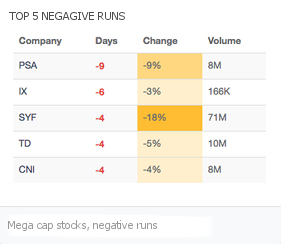

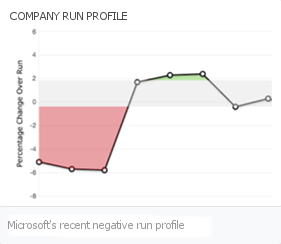

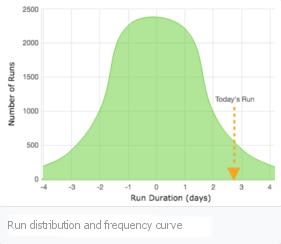

Our investment premise is simple. Stock prices rarely go up, or down, for an extended period of time. Stocks that are tearing it up and increasing in price every day are bound to eventually come back down to earth.

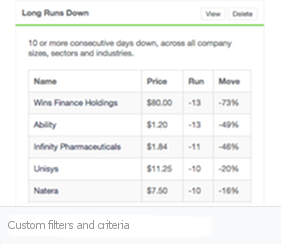

Stocks that get pummeled lower ever day will usually, eventually, stop their perilous, downward slides. We track and analyze these stock price "runs" every day and are excited to share this

analysis with you. And yes, we

use our own tools to guide our own

stock investments.